Based on the latest data and trend analysis, in October, the sales volume of power and energy storage batteries in China increased by 4.7% compared to the previous month, while the production volume decreased by 0.1%. The competition in the power battery sector is intensifying, prompting companies to continually seek ways to reduce costs and increase efficiency. At the same time, they are also exploring opportunities in the energy storage market to find new growth points. In the future, battery companies need to pay attention to changes in market demand, optimize product structures, and adapt to the intense market competition.

Recently, the latest data released by the China Automotive Power Battery Industry Innovation Alliance showed that in October, the trends in production and sales of power and energy storage batteries have shown differentiation. The sales volume increased by 4.7% compared to the previous month, while the production volume decreased by 0.1%.

The overall inventory of power batteries is on the high side, and the focus for the entire year is to “reduce costs and destock”. Despite the increase in overall market share, terminal demand varies. Various battery manufacturers are expanding their production capacities to match the demand. According to research data from Mysteel, as of November 2023, the total capacity of domestic lithium batteries in various projects exceeds 6,000GWh, with 27 battery samples having a combined capacity of 1780GWh, and the overall capacity utilization rate at 54.98%.

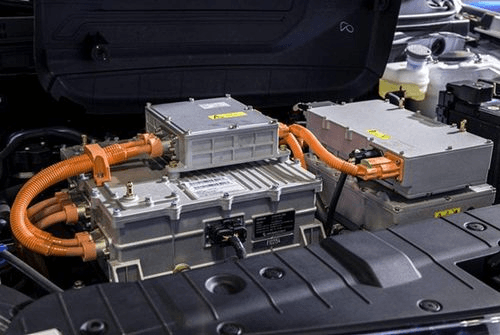

On the other hand, the data indicates an intensifying competition in the overall power battery sector. In October, the data for power and energy showed a decrease in the number of enterprises providing matching power batteries for new energy vehicles. In that month, a total of 35 companies provided matching power batteries for the new energy vehicle market, a decrease of 5 from the same period last year. From January to October, a total of 48 power battery companies provided matching power batteries for the new energy vehicle market, a decrease of 3 from the same period last year.

Furthermore, the current competition in power batteries is becoming more intense as a result of the decline in battery demand and the slowing growth of the global electric vehicle demand.

According to SNE research, to reduce the highest proportion of costs in electric vehicles- the battery costs- more and more enterprises are beginning to utilize the more price-competitive lithium iron phosphate batteries compared with ternary lithium batteries. According to monitoring data from platforms like SMM, the recent average price of battery-grade lithium carbonate is around 160,000 CNY per ton, showing a significant year-on-year decline.

In addition, the future incremental market will not only involve the export of power batteries but also the substantial potential of the energy storage market. With the energy storage sector currently in an opportune development period, numerous battery enterprises are investing in energy storage battery projects. Energy storage businesses are gradually becoming the “second growth curve” for some power battery companies.